Running a growing business is exhilarating, but keeping track of every Invoice, Payroll Entry, and Bank Reconciliation rarely makes the top of an entrepreneur’s priority list. Bookkeeping may not directly drive revenue, but it does provide the financial clarity every decision-maker needs.

Without reliable data, scaling is risky, and managing cash flow becomes a game of guesswork. This is where a virtual assistant for bookkeeping steps in as a game-changing solution.

Why Virtual Assistant Bookkeepers Matter Today

In today’s hybrid and remote work era, many companies are moving away from hiring full in-house bookkeeping teams. Instead, they indulge VA bookkeepers – skilled remote professionals who take full ownership of financial processes and are more cost-effective than traditional hires.

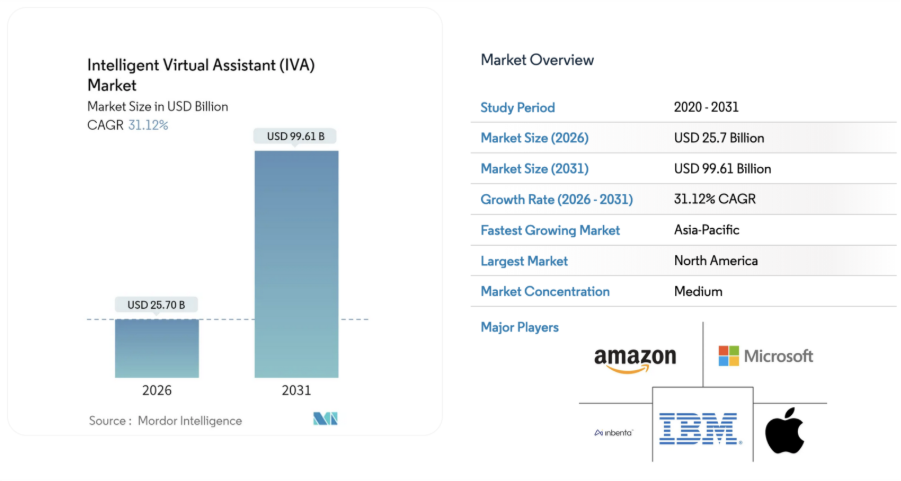

The global market for virtual assistants is projected to reach $25.7 billion by 2026 and 99.61 billion by 2031, driven by growing adoption across the legal, healthcare, and e-commerce sectors (Mordor Intelligence). For SMEs, offshore bookkeepers help free up leadership bandwidth, reduce payroll overhead, and maintain financial systems without adding office headcount.

Why Software Alone Isn’t Enough

Modern bookkeeping tools have simplified data entry, reconciliations, and expense tracking. However, software alone often falls short in addressing strategic financial needs.

Programs can record transactions, but they can’t resolve irregular billing disputes, manage vendor issues, or provide meaningful insights into shifting profit margins.

That’s why many businesses choose to work with a virtual bookkeeper who not only ensures accuracy and compliance but also brings the human judgment required to interpret reports, communicate effectively with CPAs and lawyers, and provide clarity that goes beyond the capabilities of automated systems.

Don’t Ignore These Signals – It’s Time for a Virtual Bookkeeper!

Many small business owners begin with spreadsheets and basic accounting platforms. However, as transactions increase, the hidden cost of DIY bookkeeping becomes apparent. If these apply to you, it may be time to delegate:

- You spend more than 1–2 hours per week updating books.

- Reconciling accounts delays your monthly reporting cycles.

- Growth decisions rely on assumptions instead of data-backed reports.

- Your CPA must “clean up” your files before tax season.

According to surveys and industry reports, business owners who outsourced bookkeeping saved between 200 and 400 hours per year – time redirected toward strategy, product development, and marketing.

Scope of Work: Tasks Virtual Assistant Can Handle

A virtual assistant for bookkeeping can manage every core function of financial tracking, including:

- Accounts payable and receivable

- Invoicing and collections

- Payroll administration

- Vendor coordination

- Bank and credit card reconciliations

- Monthly reporting and financial dashboards

- Budget creation and variance analysis

Unlike limited AI tools, a remote virtual bookkeeper engages directly with your team, provides customized reporting, and adapts to workflows across platforms such as QuickBooks, Xero, Wave, or FreshBooks.

Save More, Stress Less: Virtual Assistants vs. In-House Teams

Bringing on full-time finance staff can prove costly, with expenses spanning salaries, benefits, training, software licenses, and additional infrastructure. In contrast, hiring a virtual bookkeeper offers a far more flexible and cost-effective alternative.

With the remote VA bookkeeper, your business can easily adjust the level of support you need, whether that’s just a few hours each month or comprehensive, full-time assistance based on your actual transaction volume and reporting requirements. This scalability means you get exactly the expertise you need, right when you need it, without paying for excess capacity.

Furthermore, when you work with a reputable remote staffing agency, you benefit from thorough candidate screening and ongoing post-hire support. We help ensure you always have access to highly qualified professionals and reliable bookkeeping practices, while streamlining your operations and keeping your overhead lean.

Grow With Confidence: Your Financial Edge

Clear financial insights are crucial for making confident business decisions. Regardless of whether you manage a healthcare practice, online shop, or consulting firm, spending valuable time on manual spreadsheet updates isn’t efficient or sustainable.

By partnering with a skilled virtual bookkeeper, you benefit from:

- Accurate financial reports that inform your growth strategies

- More time and energy to devote to your clients, patients, or products

- Scalable systems that adapt as your business changes

Combining advanced technology with professional expertise, a virtual bookkeeper ensures your financial data is not only organized but also thoroughly analyzed and strategically aligned with your business objectives.

Final Thought

Bookkeeping done right is not just about adjusting the books; it is about clarity and confidence that power smarter growth. A VA bookkeeper, whether offshore or locally aligned, transfers the mix of affordability, adaptability, and human judgment every modern business needs.

Entrepreneurs do not have to choose between doing it themselves or hiring costly in-house staff. By working with a virtual bookkeeper, you stop second-guessing financials and start making data-driven decisions with accuracy and speed.